China’s falling conglomerates and economic squabble

China’s red princelings have jumped into running vast business empires due to their right connections with right links but their entrepreneur skills have failed to pass the litmus test after they climbed certain heights.

There are now hundreds of examples where families or past leaders belonging to Communist Party of China and People’s Liberation Army have mustered huge profits and large business empires without any problem.

But a clash interest is fast brewing among the princelings who are getting into party squabbling in public to score their point and knock out possible or existing opponents.

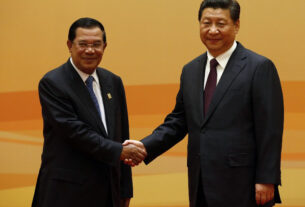

In fact, Chairman and President Xi Jinping has been propogating about red brotherhood to unite these prinelings to work for the advancement of Chinese state and for themselves but within a just limit in which they do not interfere in other activities.

So far that approach has failed to produce tangible result. Jinping’s sister Jia Qiaoqiao is the mediator in many red family associations mainly in Guangdong region. She is the contact for Jinping and a go between the powerful Ye family of the province which belongs to Hakka tribes.

For example, General Ye Xuanning of Ye clan is a good friend of Weng Zhenjie who is the Chongquing mafia Group. Both are good friends of Xi’s Yuanping the younger brother of Jinping.

The Ye family is also asserting its influence within Xi’s inner circle as Cao Qing, the body guard of Marshal Ye Jianying, is now a trusted man.

Massive corruption

But many business houses in China are now grappled by secret money of the state and massive corruption is now staring at a bigger crisis if this trend persists. Jinping is realizing limits to his power but he is now making concessions to those princelings to buy the present.

It is not new in China that many business leaders and banking managers just vanish overnight.

Just a few months ago, Wu Xiaohui, chairman of China’s troubled Anbang Insurance Group, was in New York trying to secure a better credit rating for the voraciously acquisitive company he founded in 2004.

Now he has disappeared, unseen since May, and is believed to have been detained by the authorities. Anbang said on June 13 that Wu was unable to fulfill his duties at the company he founded for personal reasons.

His disappearance ends a long period during which Beijing-based Anbang used yuan deposits in China to serve as collateral for offshore borrowings used to pay for acquisitions such as the $1.95 billion purchase of the Waldorf Astoria hotel on Park Avenue in New York.

Informal measures designed to discourage capital outflows from China were making such financial arrangements increasingly difficult.

Moreover, Anbang has suffered from regulatory moves against a range of wealth management products based on insurance policies that have fueled out-of-control credit growth and asset value bubbles, particularly in the property market.

The danger of the invisible leverage that these products provide has been magnified by the fact that most are short term, while the money raised has gone into much longer-term projects. What appeared to be traditional life insurance products were actually high-risk investment products with no transparency about who- if anyone-stood behind them.

Wu is one of a new generation of Chinese entrepreneurs who have taken advantage of political and regulatory connections to build corporate empires at home and then invest abroad. Others include Chen Feng, the founder of Hainan-based HNA Group, a finance-to-aviation conglomerate, and Guo Guangchang, one of the founders of Shanghai-based Fosun International, an insurance and investment group.

In the process, they have bought assets ranging from high-profile professional sports clubs such as England’s Wolverhampton Wanderers to Club Mediterranee, a French tour operator.

Other trophies include distressed financial companies in the U.K. and Continental Europe, residential property in Japan, and hotels and the Canadian Cirque Du Soleil entertainment group in North America.

All these entrepreneurs profess huge admiration for Warren Buffett, the deal-making chairman of Berkshire Hathaway, a successful US-based conglomerate holding company. But what they admire is less the value discipline of the so called “Sage of Omaha” than his use of other people’s money.

The premiums that insurance companies collect on life insurance policies are intended to cover contingent liabilities-pay-outs on claims.

They are not “free money,” as some Chinese insurers appear to believe. Part of Wu’s problem is that Beijing has now identified this risk. “The government is taking draconian measures to make sure these companies don’t bring on a financial crisis,” said a top executive in one of the most powerful financial firms in China.

Wu differs from his counterparts at Fosun and HNA in ways that have made him more vulnerable than them. Other serial acquirers have relied on listings outside China and massive bank borrowings to finance their ravenous appetites for foreign assets, and have thereby become too big to fail.

For example, Guo was detained by police in December 2015, apparently caught up in a Communist Party disciplinary investigation in Shanghai, but was released after four days, in part because Fosun’s lenders appealed to Beijing for his release. They pointed out that if the company was unable to repay its debts, Guo’s difficulties would swiftly be transmitted to them. Similar fears of financial contagion will likely give HNA the same sort of lease on life.

Wu has not borrowed as heavily from banks as HNA and Fosun. But he also had access to fewer financing alternatives outside the Chinese mainland. In particular, Anbang lacked the transparency necessary for a quotation on an overseas stock market.

Some investment banks, including Morgan Stanley, told their head office compliance departments that the reputational risk involved in helping Anbang to list would be too great. Anbang officials say that credit rating agencies refused to give the company an investment grade rating (which would have enabled it to issue debt abroad at an attractive price) because Wu could not provide adequate information about his shareholders.

Wu’s indifference to the rules also alienated regulators. A failed $13 billion bid for the U.S. Starwood Hotels and Resorts chain, for example, violated Chinese limits on spending on a single offshore deal. When advisers suggested to Wu that he should obtain regulators’ permission in advance of the bid, and line up secure financing, he told them that was unnecessary because he knew “everyone from the chairman to the doorman” at the China Insurance Regulatory Commission.

Wu had to withdraw abruptly from the bidding, giving rise to complaints from rivals that they would have to pay higher premiums for overseas assets in future because he had proved to be such an unreliable bidder. “Anbang is the most egregious company,” one regulator recently said. “It has grown much too fast and it has no management.”

Wu ultimately fell victim to a combination of two forces: Beijing’s determination to control capital outflows, and the poisonous politics of the capital. He alienated some of Chinese President Xi Jinping’s closest associates as well as the regulators. Although he married into the family of China’s former paramount leader Deng Xiaoping, he never had the family’s protection; he and his wife have lived separate lives for several years.

It is not clear what Wu’s fate will be. Neither is it certain whether Anbang can survive without its founder. Insiders in Beijing believe that Wu will be removed, and that Anbang’s operations will be wound down over time. Holders of the company’s investment products will surely be compensated to avoid mass protests, but its business could be merged with a stronger rival such as China Life or Shenzhen-based Ping An.

Risky investments

Anbang was always regarded as a one man show. Precisely because of that view, the contagion effect is likely to be far less than might be feared if others who sought to fly without parachutes run into similar difficulties.

Meanwhile, shares in companies related to entertainment giant Dalian Wanda, consumer group Fosun International and conglomerate HNA have suffered lot of uncertainty after reports that China’s banking regulator was conducting checks on the borrowings of some of the country’s biggest overseas deal-makers.

According to several foreign news outlets, the China Banking Regulatory Commission has instructed banks to examine their exposure to a number of companies, including unlisted insurer Anbang. Authorities are believed to have detained Wu Xiaohui, chairman of Anbang recently.

Rossoneri Sports Investment Management Changxing, the new owner of Italian football club AC Milan, is also thought to be on the list.

Shares in Wanda Film Holdings rose as much as 3%, to 53.49 yuan, on Friday. A day earlier, trading in the shares was halted. Fosun International and Shanghai Fosun Pharmaceutical issued a statement late Thursday saying their businesses are being run appropriately; their shares rebounded as well on Friday.

The companies that banks have been told to look into have been on an aggressive foreign acquisition spree over the past several years. In 2015, Wanda acquired a 20% stake in the popular Spanish football club Atletico Madrid. Fosun owns Canadian entertainment company Cirque du Soleil and Club Mediterranee SA, better known as Club Med. Anbang is known internationally for its purchase of New York’s Waldorf Astoria, and HNA last year bought 25% of the Hilton hotel group.

Excluding Rossoneri, the four other companies are reported to have spent $56 billion buying up foreign assets over the past five years-an enviable shopping expedition that has nonetheless led to questions regarding indebtedness, ownership structures and their financial transactions.

In particular, Anbang and Fosun have used sales of risky investment-style insurance policies to fund foreign acquisitions that authorities had previously cracked down on.

China’s leadership is also thought to be mindful of reputational damage that could be inflicted on the country should one or more of the companies under investigation suffer a financial failure that risks the survival of their overseas business assets.

“Beijing can’t be faulted for wanting to understand the implications of major outbound acquirers’ meteoric balance sheet expansion,” said Brock Silvers, managing director at Shanghai-based investment advisory Kaiyuan Capital. “These are generally positive and rational moves.”

Apart from “reflect[ing] Beijing’s long-awaited response to systemic economic risks,” these probes are “to ensure a smooth run-up to the all-important 19th party congress this fall,” Silvers said.

The checks that the banks are now being asked to do is an extension of an ongoing clampdown on the financial sector. On an almost daily basis, penalties have been meted out against the country’s commercial banks and distressed asset managers. According to the banking regulator, 485 cases of misconduct were cited and 197 people in the industry found guilty in the first quarter of the year. Market participants were fined a total of 190 million yuan ($27.8 million) in the period.

The prosecution grew more intense following the appointment of reformist Guo Shuqing as head of the China Banking Regulatory Commission in March.

The misconduct included transferring loans in batches, buying financial assets from peers, manipulating key performance indicators, and failing to detect and report suspicious activities. There were also cases of selling wealth management products-a favored vehicle of the shadow financing sector that allows banks to bypass capital and regulatory requirements.

The insurance sector is also in the crosshairs. Foresea Life and the insurance unit of property developer Evergrande Group-known for putting insurance funds into high-risk assets such as listed shares-had their chairmen barred from the industry.

The crackdown on some of China’s largest private companies is either part of Beijing’s yo-yo economic policy, encouraging companies to expand and then pulling them back when the financial risks skyrocket or it is part of the larger factional political battles in Beijing.

The companies [now being looked into] became bolder by targeting foreign takeovers. The risks magnified and drew the focus from sources such as the US Congress. This was worrying to Beijing, so it began forcing the companies to pull in their horns, using the banks as their proxy.